Basics of Selling Options

What are Options

Option is actually contracts between buyers and sellers, covering #100 shares of underlying( stock or ETFs ). They work a lot like insurance: one side pays a premium for protection or opportunity, while the other side collects that premium in exchange for taking on an obligation of buying at specific price.Options chain

• strike price

• expiration date

• price

Strike - is agreed price 'level' on the CONTRACT. Where seller is happy to buy 100 shares for which he is rewarded with a premium. While the buyer pays that premium for protection if the stock moves to this level.

Expiration date → The last day the option contract is valid, after which options become worthless( might be good thing for the sellers ).

Price (premium) → The upfront cost paid by the buyer to hold the option, collected by the seller.

Options Chain for GOOGL expiring in 45 days ( 45DTE )

Selling options allows you to collect a premium in exchange for committing to purchase #100 shares of the underlying asset at a price lower than its current price.

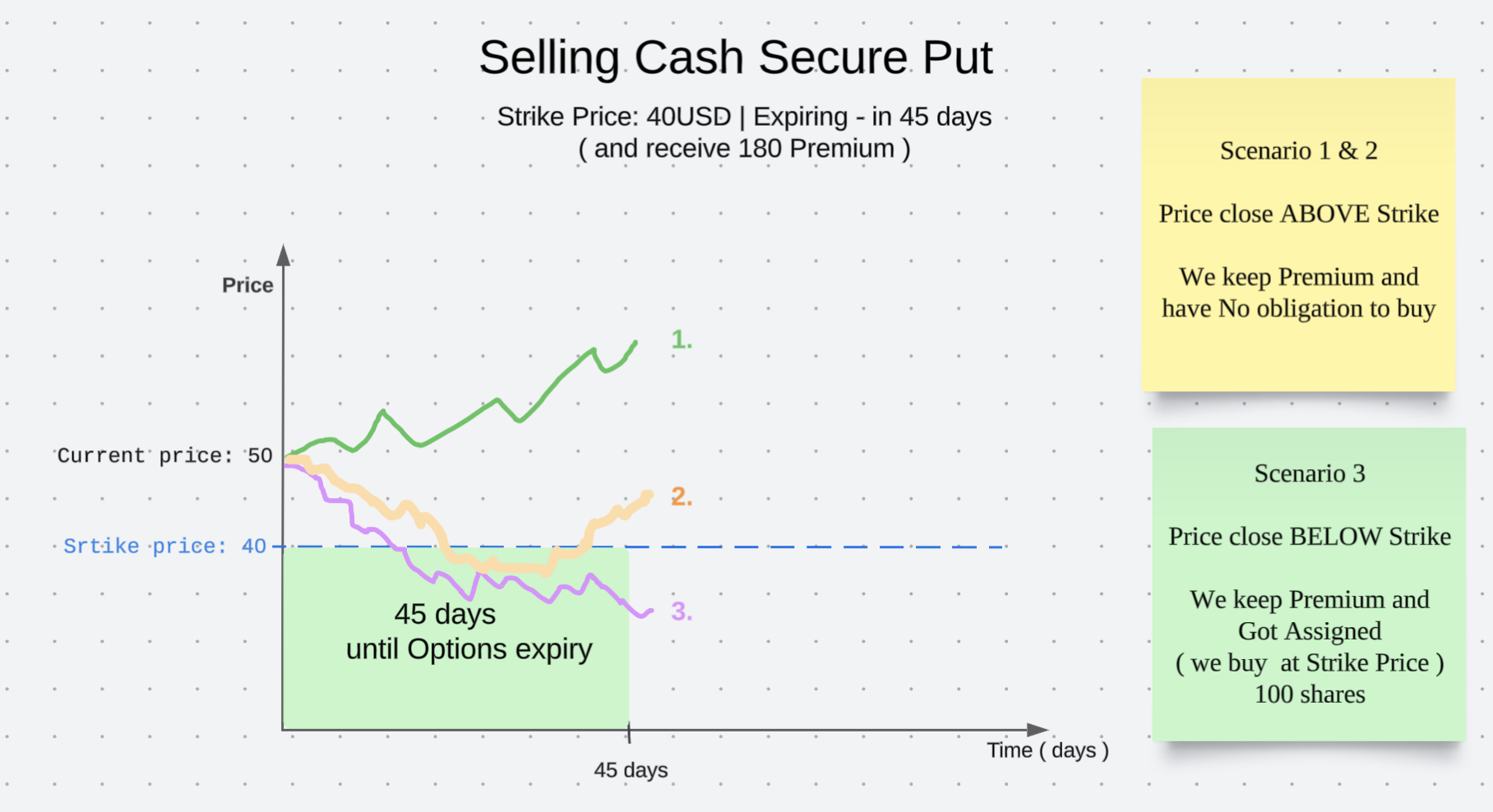

Selling Cash Secure Put

You receive Premium, in exchange you commit to buying 100 shares of the underlying stock you want to own, at the strike price (lower than it is Today) on or before the expiration date —if the price drops BELOW Strike price we have chosen.

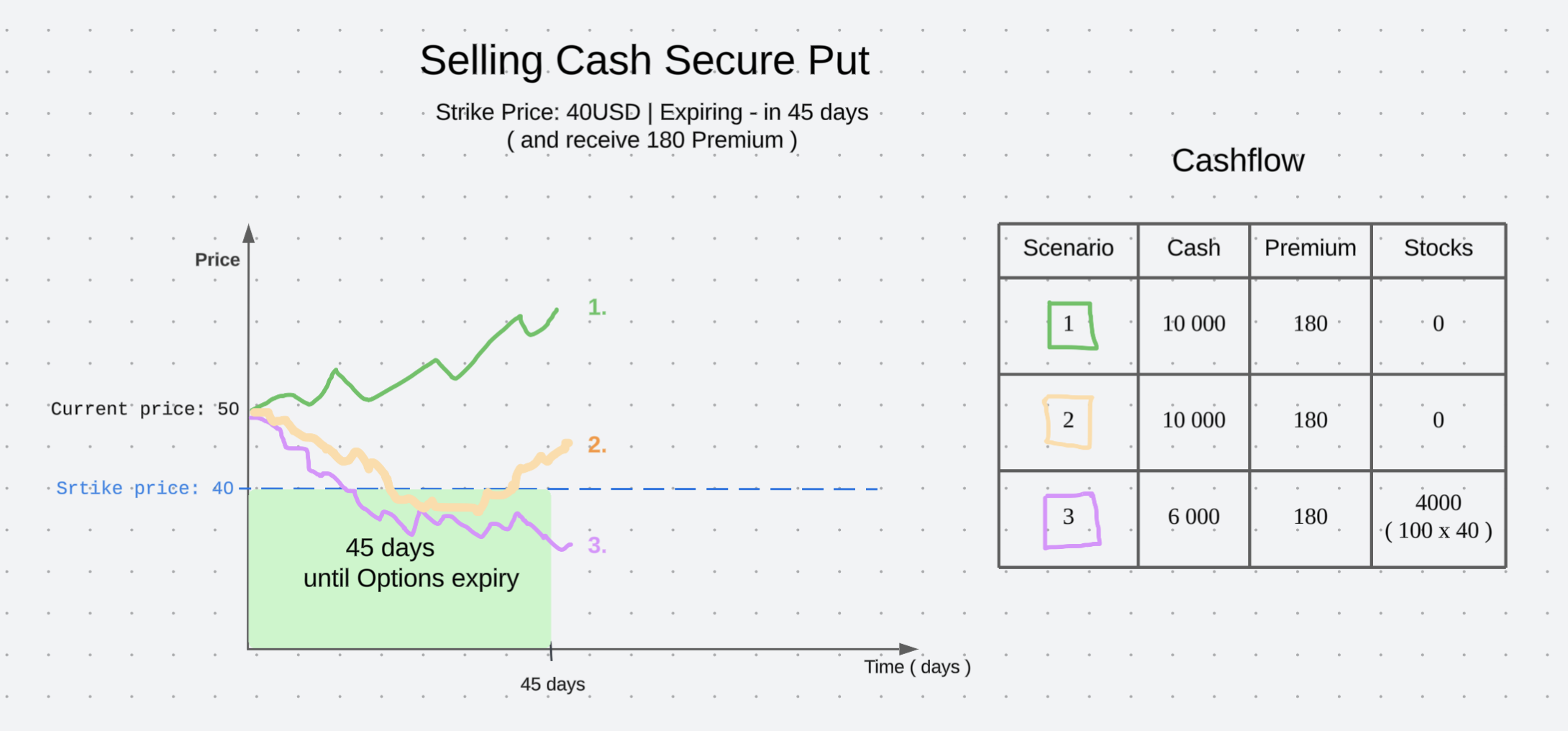

Cashflow

In scenario 1 & 2 price closes ABOVE Strike price. We collect Premium and keep Cash intact.

In Scenario 3, when Price closes BELOW Strike price at Expiration Date, we will be assigned 100 shares at Price equal to Strike price we have chosen.That means we automatically Buy at price 40 and now can start Selling Covered Calls as we now gonna own 100 shares.

In all cases, we have generated a 1.8% (ROC) yield in 45 days from a hypothetical $10,000 ( illustration purposes only ).

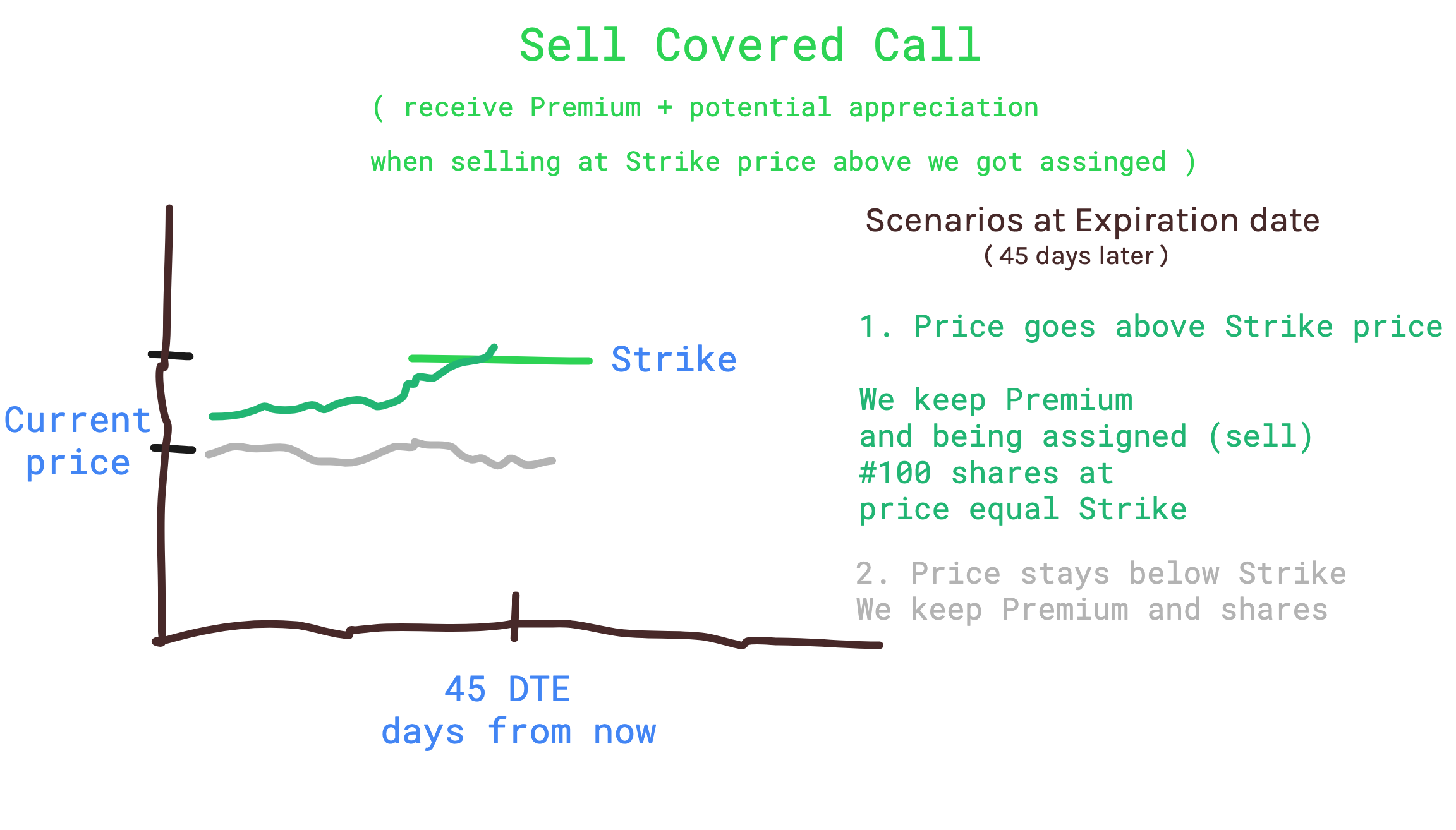

Selling Covered Calls

You receive Premium, in exchange you commit to selling 100 shares of stock you own at the strike price on or before the expiration date —if the option is assigned.